Filing the Articles of Organization is the first step in forming a Limited Liability Company (LLC) in Texas. The Texas Secretary of State views this document as your business’ birth certificate. It gives your company legal existence and ensures your business structure is recognized under state law. For new business owners and entrepreneurs, understanding how this filing works is essential to operating legally and protecting their assets.

When you understand the context, the process is quite straightforward. LLC Articles define your LLC’s purpose, structure, and identity. Every serious business owner in Texas must complete this step to separate personal liabilities from business risks. You’ll also need to stay compliant by checking your Franchise Tax Account Status Search regularly. If you’re starting a local business or expanding to Texas from another state, this guide will help you file the Articles of Organization correctly.

What Are the Texas LLC Articles of Organization

The Articles of Organization are legal documents that formally register your company with the Texas Secretary of State. They establish your business as a legal entity separate from you and provide public information about your company’s structure and operations. The document includes your LLC’s name, registered agent, purpose, management type, and principal office address.

You cannot legally operate your business in Texas without filing these articles. Upon approval, your LLC becomes legally entitled to enter contracts, open business bank accounts, and protect its members’ assets. Essentially, the Articles of Organization define your company’s rules, define ownership, and give your company legal legitimacy.

Importance of Filing Articles of Organization in Texas

Articles of Organization are more than just legal requirements – they are the gateway to building a strong, credible company in Texas. Your personal finances are separated from your business obligations, which means that in case of a lawsuit or financial crisis with your business, your savings, home, and other assets are safe.

It also helps establish trust among banks, investors, and clients. You gain more credibility when people can verify your LLC’s registration through the Texas Secretary of State’s database. Additionally, filing your Articles of Organization ensures that your company is in compliance with Texas business laws.

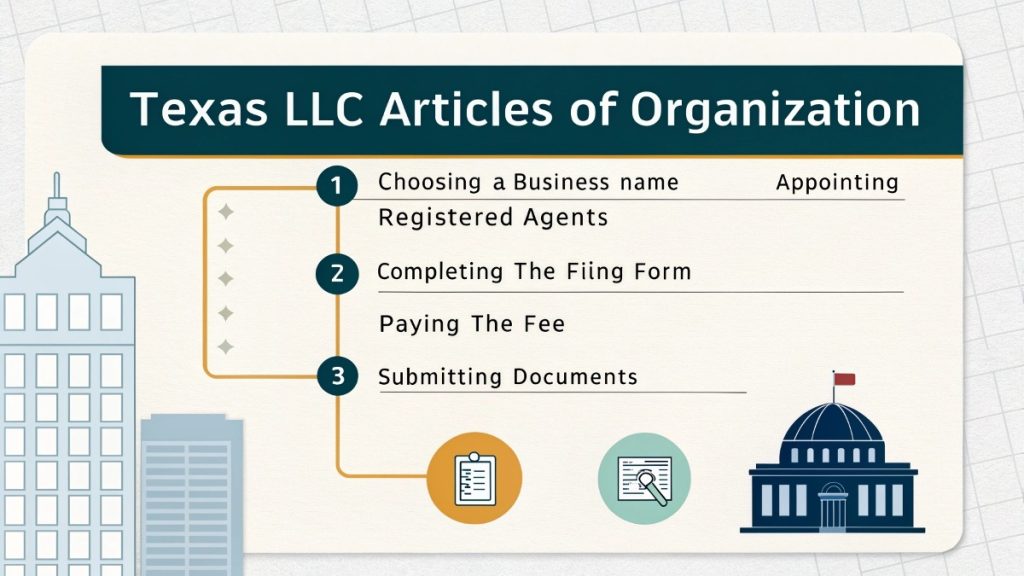

Preparing to File the Texas Articles of Organization

Before filing, preparation is key. Your business name must comply with Texas naming rules. It should be unique, not similar to any existing entity, and include the words Limited Liability Company or its abbreviation (LLC or L.L.C.). Checking name availability through the Texas SOS Direct online portal is the first step.

The next step is to choose a registered agent to receive legal documents on behalf of your business. The registered agent must be a Texas resident or a business authorized to operate in Texas. You’ll also need to decide whether your LLC will be member-managed (run by owners) or manager-managed (run by appointed managers). This information ensures a smooth and speedy filing process.

Steps to File the Texas LLC Articles of Organization

SOS Direct is the website you can use to file your Articles of Organization in Texas. You’ll find Form 205, which is the official Certificate of Formation for an LLC. This form can be submitted online, by mail, or in person. Online filings get approved in two to three business days, on average.

The filing fee is $300, payable to the Texas Secretary of State. If you’re mailing your application, send it to the P.O. Box in Austin, TX. As soon as you submit your Articles of Organization, a stamped copy will be sent to you, confirming official recognition of your business by the state. Keep this document safe – you’ll need it for banking, tax registration, and compliance filings in the future.

Information Required in the Articles of Organization

The Articles of Organization request specific information that defines your company’s structure. This includes:

- LLC name and address

- Registered agent’s name and office address

- Management structure (member- or manager-managed)

- Business purpose

- Duration (if not perpetual)

These details are public records, so ensure they’re accurate and professional. This information helps the Texas Secretary of State ensure transparency about who owns and operates businesses in the state. The wrong or incomplete details can cause a delay in approval or possibly lead to future legal issues. Always double-check before filing.

After Filing: What Comes Next

When your Articles of Organization are approved, your LLC officially exists – but it is not the end of the story. Create a company operating agreement that outlines ownership, management duties, and profit sharing. Texas does not require it, but it’s a smart way to prevent internal conflict.

Next, get an Employer Identification Number (EIN) from the IRS. You’ll need this number to pay taxes, hire employees, and open bank accounts for your business. If your business sells goods or employs staff, you must also register with the Texas Comptroller. Completing these post-filing steps keeps your LLC compliant and functional from day one.

Common Mistakes to Avoid When Filing

Most first-time entrepreneurs make filing errors that delay or cause rejection. Common mistakes include choosing a name that is already in use or missing “LLC” from the title. Some people forget to name a registered agent with a physical address in Texas – P.O. boxes are not accepted.

A common mistake is not providing accurate or consistent information across filings. For instance, if your business address or registered agent name differs from what you used in other legal documents, the Secretary of State may flag your application. Following the official Texas SOS guidelines and double-checking details can save you money, frustration, and time.

Benefits of Forming a Texas LLC

A Texas LLC has several advantages. The most important one is limited liability protection: your personal assets are shielded from business debts and lawsuits. Furthermore, this structure offers members a choice between pass-through taxation and corporate taxation.

As an added benefit, Texas doesn’t tax individual income, making it a popular state for entrepreneurs. You’ll also enjoy a simple compliance process, a strong economy, and access to business-friendly resources.

Maintaining Compliance After Filing

After your LLC is formed, maintaining compliance ensures your business remains legally compliant. Texas requires LLCs to file a Franchise Tax Report and a Public Information Report each year with the Texas Comptroller. These filings maintain your business records and keep your status active with the state.

Your registered agent information must also be updated immediately if your business structure or address changes. Non-compliance can result in penalties, loss of good standing, or even dissolution. Keeping your LLC up to date with filings is necessary for long-term security and credibility.

How Long Does It Take to File a Texas LLC

The processing time depends on your filing method. Online filings through SOS Direct usually take two to three business days. Mail filings typically take seven to ten business days to process. Expedited services are available for an additional fee, which reduces the wait time to one day. Your submission may be delayed if it contains errors or missing details. Your business name should be unique, and all fields on the Certificate of Formation should be double-checked. Proper preparation prevents unnecessary delays.

Cost of Filing the Articles of Organization in Texas

Cost of Filing the Articles of Organization in Texas Filing the Articles of Organization costs $300, payable to the Texas Secretary of State. This fee applies whether you file online or by mail. Even though it may seem steep, it is a one-time fee to establish your Texas business legally.

There may be additional costs associated with professional filing services or expedited processing. An EIN (free from the IRS), a registered agent service, and drafting a Texas LLC Operating Agreement may cost you additional money. You need to invest in a proper setup to ensure your business starts off strong and remains compliant in the long run.

FAQs

What are the Articles of Organization in Texas?

The Articles of Organization, officially called the Certificate of Formation, is a legal document filed with the Texas Secretary of State to establish an LLC. It defines your company’s structure, purpose, and ownership details. Without this filing, your business doesn’t legally exist in Texas, so it’s the first and most crucial step in starting your company.

Where can I file the Texas Articles of Organization?

You can file online through the SOS Direct portal, which offers the fastest processing time. Alternatively, you can file by mail or in person at the Secretary of State’s office in Austin. Online filing is preferred by most business owners since it allows real-time tracking and quicker approval.

How much does it cost to file the Articles of Organization?

The standard filing fee in Texas is $300, payable by credit card, check, or money order. This fee covers the cost of registering your LLC with the state. Expedited processing services may add to this amount if you need approval faster than the standard timeline.

How long does it take to get my Texas LLC approved?

If filed online, approval typically takes two to three business days. Mailed filings can take up to ten business days, depending on workload and accuracy of your information. Choosing expedited processing can reduce this to just one day, ensuring a quick start for your business.

Can I file the Articles of Organization myself?

Yes, you can file independently through the Texas Secretary of State’s SOS Direct website. However, if you’re unfamiliar with the process, hiring a professional filing service ensures all details are accurate. Mistakes in filing can cause costly delays or rejection.

What happens after my LLC is approved?

Once approved, you’ll receive a stamped Certificate of Formation confirming your LLC’s legal existence. Next, you should create an Operating Agreement, apply for an EIN, and register for state taxes if necessary. These steps finalize your setup and keep your LLC compliant.

Is a registered agent required for Texas LLCs?

Yes, Texas law mandates every LLC to appoint a registered agent. The agent receives legal and government correspondence on behalf of your business. They must have a physical Texas address and be available during normal business hours.

Can I use my home address for my LLC in Texas?

Yes, you can use your home address as your business address if you operate from home. However, your registered agent’s address must be a physical location within Texas. Many business owners prefer using professional registered agent services for privacy reasons.

What if my Texas LLC name is already taken?

If your chosen name is unavailable, you must select a different one that meets Texas naming rules. You can check name availability through the SOS Direct portal before filing. It’s always best to verify early to avoid rejection and delays.

Do I need an Operating Agreement in Texas?

While not legally required, an Operating Agreement is strongly recommended. It defines how your LLC operates internally, including member roles, profit distribution, and dispute resolution. Having this agreement prevents conflicts and strengthens your company’s legal foundation.